Smoothed funds - the holy grail of retirement planning?

- Noel Watson CFPᵀᴹ - Chartered Wealth Manager

- May 7, 2024

- 3 min read

Updated: Jun 11, 2025

Introduction

Smoothed funds are often seen as helping investors of a more nervous disposition remain invested during volatile markets. These funds offer "smoothed" prices and aim to shield the investor from the volatility of the underlying investments, thereby providing some reassurance. For example, the smoothed fund might take an average of the daily price of the underlying holdings over the last six months, which will be the headline price shown. Some of the fund growth may be held back during good times, and these reserves are then used when needed.

Some also claim that these funds' smoothing effect helps alleviate the Sequence of Returns Risk (SORR).

Let's investigate whether these funds belong in a retirement portfolio.

Does smoothing work?

The COVID pandemic showed some smoothed funds in a good light, insulating clients from some of the market falls that they might have suffered if they had invested in more "conventional" alternatives, such as a portfolio consisting solely of equities and bonds.

Let's compare the smoothed fund approach to a "real world" example portfolio a client may hold. We have chosen a "no-brainer" portfolio (NBP) containing 60% equities and 40% bonds.

We have selected three popular smoothed funds and will compare them with NBP, starting with the COVID market turbulence. NBP is the green line, with the smoothed funds in blue, red and orange.

We can observe the following:

Smoothed funds are not immune to market falls, which (apparently) surprised some financial advisers.

The implementation of smoothed funds differs - compare the relative outcomes of the red and orange smoothed funds.

When viewed over this timescale, the smoothed funds appear to have offered advantages compared with NBP. All had a maximum drawdown of less than 10% (the red smoothed fund was relatively unimpacted), whereas the NBP fell around 14%.

As we pointed out in our SORR article, the COVID-19 downturn was short-lived and may have favoured the smoothing approach. What if we look at more extended market downturns, starting with 2022? How would our three smoothed funds have fared?

The red smoothed fund, the best performer of our COVID scenario, has suffered, falling around 11% over the year, around 4% more than the NBP. The blue and orange funds have fared much better.

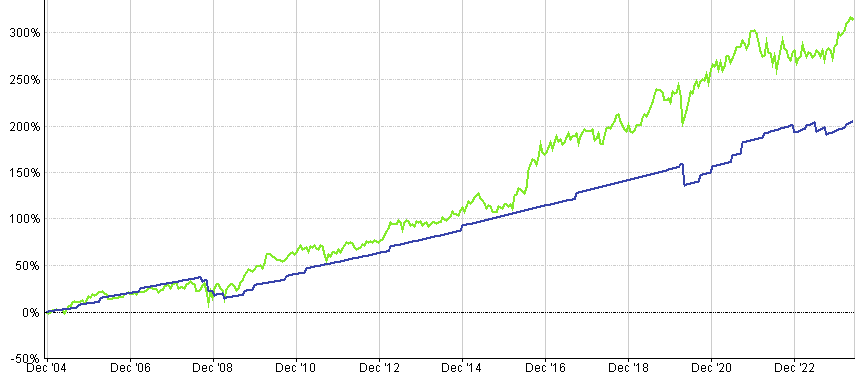

Let's go back to the Global Financial Crisis when global equities suffered for several years. This is where we run into our first problem - the blue smoothed fund was the only one of the three in existence.

Over the period, we can see that both the smoothed fund and NBP fell around 20% from peak to trough. The smoothed fund took far longer to return to the previous high and was around 20% behind the NBP at the end of 2009.

Since the end of 2004, NBP has returned around 50% more than the smoothed fund. This difference may be due in part to differences in asset allocation, but it shows that over the period, NBP suffered from broadly the same downside while offering far more upside.

Conclusion

Principle 10 of "How we invest our client money" emphasises the importance of taking a long-term view, both in terms of investment horizons and looking as far back in history as possible. The smoothed fund approach suffers a similar flaw as we identified with the natural income approach. It isn't easily possible to go back and evaluate how retirees may have fared during challenging times in the 20th century. Given our limited data, we see similarities with the cash buffer approach. These strategies both seem to work until markets become challenging, during which they tend to show limitations, and are examples of retirement planning concepts that sound good in theory.

Our view is that it would be challenging to build a retirement strategy using this approach.

Want to find out more?

If you would like to know more about designing and implementing a robust withdrawal strategy, please contact us.

About us

The team at Pyrford Financial Planning are highly qualified Independent Financial Advisers based in Weybridge, Surrey. We specialise in retirement planning and provide financial advice on pensions, investments, and inheritance tax.

Our office telephone number is 01932 645150.

Our office address is No 5, The Heights, Weybridge KT13 0NY.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Comments