top of page

The 4% rule - is it still valid for UK retirees?

Are you using the '4% rule' for taking retirement income? In this article, we investigate the many challenges to consider.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Sep 6, 202519 min read

Retirement planning concepts that sound good in theory

Many retirement planning concepts claim to offer beneficial retirement outcomes. This post aggregates our research.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Sep 4, 20253 min read

Should I buy an annuity? September 2025 edition

Annuity rates continue to increase. We examine the impact of incorporating an annuity into a retirement plan and what to be aware of.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Sep 2, 202510 min read

We achieve CISI Accredited Financial Planning Firm™ status

Pyrford Financial Planning achieves the prestigious CISI Accredited Financial Planning Firm™ status, one of only 55 firms in the UK!

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Aug 29, 20251 min read

St James's Place's new fee structure. What has changed?

St James's Place's long-awaited new fee structure has finally arrived. We examine what has changed and what potential clients need to be aware of.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Aug 26, 20257 min read

St James's Place: Fees, performance, and what you should be asking

Reports of St James Place's poor performance and high fees regularly feature in the press. Is this criticism justified?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Aug 25, 202516 min read

Should your retirement portfolio contain 100% shares?

Retirement researcher Bill Bengen found that the optimal retirement portfolio contains 50-75% equities. Are 100% equities a better option?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Aug 6, 20257 min read

How much does financial advice cost (and am I getting good value?) Updated for 2025

We help you calculate what you are paying for your retirement planning and financial advice and whether you are getting good value.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Aug 6, 202515 min read

The S&P 500 lost decade - how to protect your retirement

The S&P 500 has generated strong returns over the past 15 years. But should you invest all of your retirement savings in this index?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Jun 23, 20258 min read

How much do I need to save for a moderate retirement in 2025?

How much does a retiree need to save for a moderate retirement? And why a larger retirement pot doesn't always provide the best outcomes.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Jun 20, 20254 min read

How much do I need to save for a comfortable retirement in 2025?

Recent research suggests that a comfortable retirement for a couple costs around £60,000 a year. What size retirement pot do you need to fund this?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Jun 19, 20257 min read

Using the Guyton Klinger withdrawal guardrails - updated for 2025

Guyton-Klinger guardrails aim to improve upon Bill Bengen's seminal research. Should retirees use this framework? What are the downsides?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Jun 12, 202512 min read

Do Autocallables have a place in your retirement portfolio?

Autocallables are often sold as a way of receiving a steady income with limited downsides. We investigate to see if there are downsides.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

May 20, 202511 min read

The "No-Brainer" portfolio - a stupid idea?

Surely successful investing outcomes require complexity? The No-Brainer portfolio shows why this isn't necessarily the case.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

May 5, 20256 min read

Does holding a cash buffer solve Sequence of Returns Risk?

Cash buffers are often suggested as a way of mitigating Sequence of Returns Risk. Do they work, or are they more of a chocolate teapot?

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

May 4, 20256 min read

7 questions to help you find the right financial adviser in 2025

Choosing the right financial adviser to help with your retirement planning is one of the most important decisions you will make.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Apr 30, 20257 min read

Ten tips for investing success in 2025

Investing is simple but not easy. We identify ten things to consider that will help you have a better retirement outcome in 2025.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Apr 30, 20253 min read

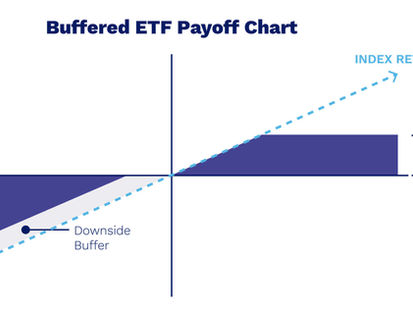

Buffered ETFs - a solution looking for a problem?

Buffered ETFs are often marketed as a way to reduce portfolio losses during market turbulence. We examine whether they have a place in portfolios.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Apr 27, 20257 min read

The Pain Index: How much can you take?

Investors are understandably often unnerved when encountering periodic market turbulence. We put recent events in context.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Apr 13, 20256 min read

What bonds should I include in my retirement portfolio?

Bonds are a key building block in a retirement portfolio. We evaluate how different bond styles influence portfolio outcomes.

Noel Watson CFPᵀᴹ - Chartered Wealth Manager

Apr 12, 20256 min read

bottom of page