Sequence of Returns Risk. A misunderstood concept?

- Noel Watson CFPᵀᴹ - Chartered Wealth Manager

- Apr 24, 2024

- 7 min read

Updated: Jun 11, 2025

Introduction

This is not the first time we have written about Sequence of Returns Risk (SORR). We wrote a blog in 2022 using some examples from Noel's book. More recently, we evaluated whether holding a cash buffer solved sequencing risk (it didn't!).

As seen from the previous two articles, SORR is the risk that the order of your investment returns will be unfavourable and impact your retirement income sustainability. There seem to be two schools of thought on this.

The first camp believes that SORR doesn't exist in the real world, evidenced by the fact that retirement portfolios did not seem to be overly impacted by the 2020 COVID market volatility.

The second camp believes that SORR is a tiger waiting to pounce whenever there is the merest hint of market volatility, tearing the retirement plan to shreds unless the retiree implements carefully crafted countermeasures (including the much-loved cash buffer).

This blog looks back in history and attempts to answer which camp we should be listening to. Maybe the answer is "neither", and SORR could potentially be the most overused and misunderstood concept in retirement planning.

A wide range of outcomes

I took the graph below from our analysis of the "4% rule." We are looking at a 30-year retirement, so the data only goes up to the mid-1990s, as someone retiring in 1998 (for example) hasn't yet lived a 30-year retirement (something we will discuss later).

There are several takeaways:

Our 1921 and 1982 retirees were very fortunate - able to withdraw an inflation-adjusted £100k a year from a £1m starting point (over 10%!) over a thirty-year retirement without fear of running out of money. Unfortunately, they would only have known this in hindsight.

Our 1915 retiree was much less fortunate, able to take around £33,700 (3.37%) from the retirement pot.

Our 1937 and 1969 retirees fared slightly better.

We will now examine the 1915, 1937, and 1969 retirees to see if their situations had anything in common that led to these less favourable outcomes. We consider these as times when SORR genuinely reared its ugly head, and even robust retirement portfolios may have come under strain.

1915 retiree:

This period was a very challenging time for our retiree, with World War 1 lasting from 1914 to 1918.

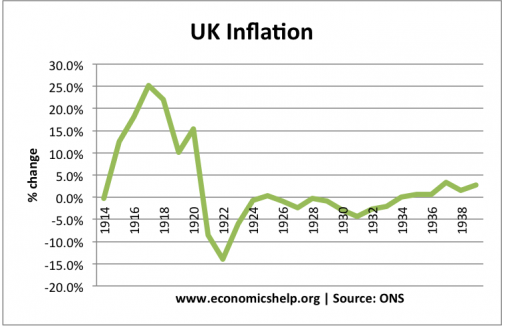

U.K. inflation was very high for the first few years, peaking at over 25% in 1917. Note that we use RPI for inflation data and this is sourced from the ONS.

The table below shows that world equities returned -31% in real terms over the period.

Given the high inflation, bonds inevitably suffered. According to Figure 33 in the UBS Global Investment Returns Yearbook 2024, global bond investors lost around 45% in real terms between 1914 and 1920.

1937 retiree

Our 1937 did not fare quite as badly as our 1915 retiree, but still had to contend with:

U.K. inflation of 16.8% in 1940 and 10.9% in 1941

U.S. stock prices falling 44 per cent between February 1937 and April 1938

World equities losing 12% in real terms from 1939 to 1948 (see table above).

The global bond index losing almost half of its value between 1939 and 1948.

1969 retiree

Our 1969 fits somewhere between our 1915 and 1937 retirees regarding unfavourable outcomes.

U.K. Inflation peaked at roughly the same level as in 1917 but persisted for longer.

In the 1973-1974 stock market crash, the Dow Jones lost over 45% of its value. The FT30 fared far worse, losing almost three-quarters of its value.

UK bond investors lost around half of their wealth in real terms between 1972 and 1974.

More recent events

Let's now look at periods when retirement portfolios may have come under stress during the 21st century. We will work back from the present day and evaluate four events:

2022 was a challenging year for both bonds and equities. From a U.S. perspective, it was one of the worst in history.

The aftermath of the .com bubble.

We will first look at equity and bond returns.

2022

As mentioned, equities and bonds were both heavily impacted from a U.S. perspective. However, the pound fell against the dollar over the year, thereby reducing equity drawdowns from a UK investor's perspective to less than 10%. Our UK retiree got lucky (assuming their equity holdings weren't FX-hedged)!

COVID

Equity markets fell heavily in mid-February but soon recovered, with central banks stepping in to avoid a rerun of the Great Depression. Over the whole year, equities and bonds showed positive returns, meaning that we can consider COVID to have had an insignificant impact on retirement income sustainability.

The Global Financial Crisis

Equities suffered far more during the GFC. But bonds performed relatively well.

The .com bust

Equities were again heavily impacted, taking several years to recover. Again, bonds rode to the rescue.

The three horsemen of the retirement income apocalypse

Looking at the testing periods from the previous century, it's apparent that SORR tends to surface when the following three scenarios occur in the early years of retirement:

Persistently high inflation.

Suffering equity markets.

Suffering bond markets.

Let's now analyse the impact of these scenarios over the four periods we covered and put them into a broader historical context.

Persistently high inflation?

Inflation spiked in 2022, potentially stressing retirement portfolios. However, it was nowhere near the >20% inflation of WWI and the 1970s and didn't persist for long. Inflation was benign over the previous three periods.

Suffering equity markets?

We now look at equity returns in the context of previous UK bear markets. COVID (#11) barely registered (as we pointed out above). The .com bust (#9) and GFC (#10) were more severe but not as bad as the 1970s.

A bear market is defined as a market fall of 20% or more. 2022, therefore, does not feature in the above chart. However, in the analysis of poor outcomes in the previous century, we looked at equity returns in real terms. If we look at real equity returns from the start of 2022 to today, we can see that they are still slightly negative (green line). But compare that to 1973-1974, when global equities almost halved in real terms, and you can see there is no comparison.

Bond returns

Finally, we look at bonds. They were relatively unscathed during COVID, the .com bust and the GFC. Admittedly, this was when analysed in nominal terms, but as mentioned above, inflation was relatively benign over these periods.

Things look a little more challenging for 2022. If we look at real bond returns since 2021, we can see that bonds have lost around 30% of their value. However, compared to periods such as the 1970s again, where bond investors lost almost half their wealth in real terms, this doesn't look quite so bad.

The first decade of retirement - .com bust and the GFC

We mentioned above that we don't yet have a full 30 years for people who retired this century. However, research by Abraham Okusanya concluded that the first decade is key for determining the likelihood of retirement success.

We have more than ten years' worth of data for our .com (year 2000) and GFC (2007) retirees.

Taking a poor historical worst case such as 1971, we see that the starting balance of £1m had been eroded to around £760k in real terms after the first decade.

Our 2000 retiree has over 50% more in the pot after ten years, with a balance of £1.19m

while our 2007 retiree had £1.86m!

Conclusion

Referring back to our two camps:

The first camp believes that SORR doesn't exist in the real world.

The second camp believes that SORR is a tiger waiting to pounce whenever there is a hint of market volatility.

We would suggest that the one thing they have in common is that they might not appreciate how bad things have been for some of our historical retirees.

Taking our four 21st-century scenarios, we can be pretty confident that our .com and GFC retirees are going to be OK, given the trajectory of their retirements so far. Given the brevity of the COVID downturn, we can discount this as a potential issue. 2022 has the potential to cause future problems, but given the sharp reduction in inflation and recovering global equity markets, we would consider this unlikely.

Realistically, we believe you have to go back 50 years to the 1970s to find a time when SORR was last a genuine threat.

If the SORR disbelievers understood how little impact COVID had versus a period such as the 1970s in terms of retirement income sustainability, they might realise that SORR is a real thing.

For retirees who believe that SORR is ever present, studying history and understanding what a robust retirement portfolio has been designed to cope with should put their minds at rest.

Our view is that SORR is something to be aware of, but it becomes a genuine issue far more rarely than some might think.

Want to find out more?

If you would like to know more about designing and implementing a robust withdrawal strategy, please get in touch.

About us

The team at Pyrford Financial Planning are highly qualified Independent Financial Advisers based in Weybridge, Surrey. We specialise in retirement planning and provide financial advice on pensions, investments, and inheritance tax.

Our office telephone number is 01932 645150.

Our office address is No 5, The Heights, Weybridge KT13 0NY.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Comments