Will Guyton-Klinger guardrails allow me to withdraw 7% a year?

- Noel Watson CFPᵀᴹ - Chartered Wealth Manager

- Sep 8, 2024

- 4 min read

Updated: Jun 11, 2025

Introduction

A big part of our job is encouraging clients to spend money in retirement without fear of running out. Many clients want to front-load their retirement spending, undertaking activities now that they might not be able to later in life. We recently discussed how cashflow planning software might not reflect the potential risks of front-loading retirement spending, and we've also covered the risks in the past when adopting the Guyton Klinger (GK) guardrail strategy.

Today, we investigate the risks of front-loading retirement spending when a retiree uses the GK guardrail approach.

Pete

Today's example client is Pete, who is 60 and about to retire. He has a retirement portfolio of £1,000,000 and would like to spend £70,000 per annum for the first decade.

He is prepared to:

Accept some cuts to his retirement income should we encounter turbulent markets.

Reduce his retirement expenditure once the first decade has passed.

As usual, we have some assumptions, and for this scenario, they are as follows:

Pete will not receive a state pension;

Taxation and taxation optimisations are ignored;

He does not plan to gift;

He does not expect any inheritances;

He is paying 1% pa in fees, which is broadly what he would expect to pay if he were a client of Pyford Financial Planning.

Pete's retirement portfolio consists of 60% equities/40% bonds with a more granular breakdown below:

36% developed market equity

12% developed market small-cap value

12% emerging market equity

40% global bonds

Baseline case - inflation-adjusted withdrawals

For our baseline, we will withdraw an inflation-adjusted £70,000 a year. We will use Timeline to model just the first decade (which might hint at how the GK approach might pan out!)

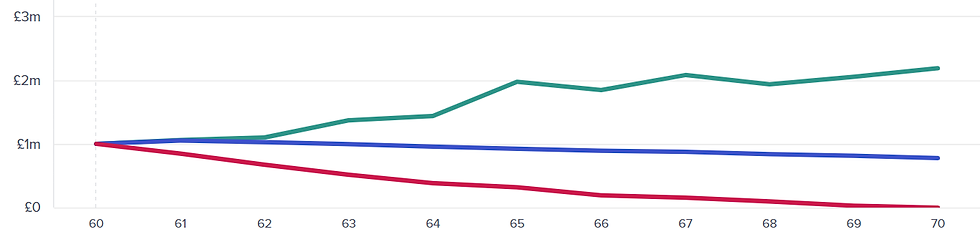

If we examine the Timeline balance chart, we can see (in real terms):

Best case: the pot has more than doubled to just north of £2m.

Median case: The balance falling by around 25% in real terms over the first decade.

Worst case: The pot is exhausted after around nine years.

Looking at the income chart, we can see how the income stops in the worst case before the decade ends.

GK Guardrails

The inflation-adjusted withdrawal approach is unlikely to be viable if the client starts by taking 7% a year. What about GK?

We will start by applying the default GK Timeline settings. For more details on the approach, please see our previous blog on GK Guardrails.

If we again start with the balance chart, we can see that the GK approach has done a far better job than the inflation-adjusted method of reducing the range of outcomes. The best case has a balance of around £2m, while the money does not run out in the worst case. That said, we'd question whether someone would stick with the plan in this scenario after watching the balance of their retirement pot fall so far.

Switching to the income chart, we can see where the main problem lies. While the median case shows a slowly decreasing real income (from £70,000 to just under £60,000 over the decade), the worst case is very challenging, with retirement income falling over 60% from £70,000 to just over £25,000 by the end of the first decade.

Would cash buffers help?

Cash buffers are often proposed as a mechanism for "protecting" the portfolio during down markets. However, we'd struggle to understand how they might operate within a rigid approach such as GK guardrails.

Should you temporarily ignore the GK strategy during down markets and start taking money from the cash buffer instead?

Do you use the cash buffer to bolster the retirement income if you experience poor GK outcomes? You would need a very big cash buffer to do this!

How does the cash buffer get topped up after being depleted?

How do you accommodate increased withdrawals at the outset from the portfolio after you have taken two years' income (for example) for the cash buffer? For example, if a £140,000 cash buffer is set aside from the portfolio, the initial withdrawal will rise from 7% (£70,000/£1,000,000) to around 8.1% (£70,000/£860,000). It's important not to double-count assets!

Conclusion

None of the above will surprise regular blog readers, but it's always worth reminding ourselves that it's essential to consider the worst-case outcomes when planning a retirement income and be comfortable accepting these.

We'd suggest that many retirees would not be happy taking 7% a year using the GK approach if they were fully aware of the downsides. We'd also question why the GK approach is considered when there are superior alternatives that better align with real-world retirement planning scenarios.

Want to find out more?

If you would like help building a robust retirement portfolio based on proven strategies, please contact us.

About us

The team at Pyrford Financial Planning are highly qualified Independent Financial Advisers based in Weybridge, Surrey. We specialise in retirement planning and provide financial advice on pensions, investments, and inheritance tax.

Our office telephone number is 01932 645150.

Our office address is No 5, The Heights, Weybridge KT13 0NY.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Comments