St James's Place's new fee structure. What has changed?

- Noel Watson CFPᵀᴹ - Chartered Wealth Manager

- Aug 26, 2025

- 7 min read

Introduction

Today (26th August 2025) marks the day when St James's Place's (SJP) new charging structure goes live. SJP says this will be simple to understand and change the perception that it is expensive. We previously covered the old charging model (and performance) and the questions to ask if you were considering becoming a client. In this article, we focus on comparing old vs new fee structures. Before we start, it's worth noting that the new charging structure applies to:

New clients.

Existing clients who make new contributions.

Existing investments in ISAs and unit trusts.

Existing investments in pensions and investment bonds remain on the old fee structure until their exit fees have expired.

The high-level changes

Change One: Ongoing fees are split into advice, product and fund charges.

The previous SJP structure bundled ongoing advice, product and fund charges into one fee, which could sometimes make it challenging for clients to understand exactly where the fees they were paying were going. The new model addresses this directly.

Change Two: Exit fees for pension and bond products are removed

Clients investing money in pensions or investment bonds under the previous fee structure paid no explicit initial fee (although the adviser still received 3% which SJP subsidised), but were liable for an exit fee of up to 6% if they left within six years.

Change Three: Some fees are now tiered

Previously, someone with £1,000,000 invested paid the same ongoing annual fee in percentage terms as someone who had £100,000 invested. This has changed in two areas:

Initial fees

Initial fees are now the same across all products (previous ISAs and unit trusts had a standard initial fee of 5% versus 0% for pensions and investment bonds, as mentioned above) and are tiered as the amount invested increases.

Product charges

Ongoing product fees are also tiered.

Worked examples

Example Client One: The average SJP client with £190,000 invested

There are several nuances in the new pricing structure to be aware of, which we will cover with some worked examples. Our first example client has £190,000 invested, which represents the average amount clients invest with SJP. This is split across their pensions (£140,000) and ISAs (£50,000). This split broadly reflects the breakdown of the existing SJP client holdings, with investment bonds (£39bn) and pensions (£102bn) grouped as they shared the same charging structure in the old model.

£5,000 is contributed annually to their ISA and pensions as summarised below.

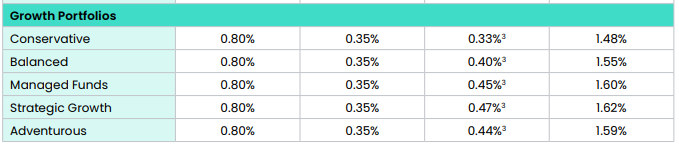

For ongoing fees, we will use an average of the five SJP growth portfolios as shown below.

Old charging model

New charging model

We will exclude transaction costs, and investment returns are assumed to be 5% gross per annum. The analysis will be run over 10 years.

At a high level, the typical client on the new charging structure is better off by around 0.07% a year (1.86% vs 1.93% per annum), taking into account both initial and ongoing fees. Note that the fees to SJP are negative in the first year in the old pricing model, as SJP effectively subsidise the adviser's initial fee (3%) for the pension investments.

In our previous SJP fee analysis, we identified three challenges with the pricing model:

1. Providing a full financial planning service to the average client.

2. The adviser is incentivised to find new business rather than looking after existing clients.

3. There was no (official) discount for larger clients.

Under the previous fee structure, the adviser was paid 0.5% of the funds under management. For the average client with £190,000 invested (assuming no initial fees for new investments (e.g. annual ISA contributions)), the adviser was paid less than £1,000 (0.5% of £190,000) a year to look after the client. Some may question how much genuine financial planning (which is typically time-intensive) can be offered at that price point. The new pricing model, with the adviser receiving 0.8%, appears to address that. However, 0.25% of this now goes to SJP, which means the adviser is only slightly better off (0.55% vs 0.5%), receiving a total of £16,489 vs £15,034 in the old model over the 10 years when taking just the ongoing fees into account.

Regarding challenge 2, in the old pricing model, the SJP adviser was paid 6 times as much (3% vs 0.5%) to find new business versus looking after clients with invested money. This differential has been much reduced, with the adviser receiving a maximum of 2% of the initial money invested (2/3 of the total initial fee) versus 0.55% for invested money.

We will now examine a client with a bigger pot of investments to evaluate the impact of tiering in the new model.

Example client two: £1m invested

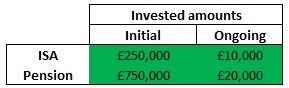

Our second client has £750,000 in pensions and £250,000 in ISAs. They invest £20,000 into their pensions and £10,000 into their ISAs each year.

The impact of tiered charges can be seen, with the client paying 0.19% per annum less over the 10 years (1.89% vs 1.70%).

As mentioned previously, the tiered charging is implemented in two areas:

Initial fees: Whereas client one paid an initial fee of 3% on their initial investment of £190,000, client two pays 1.75% on their £1,000,000 initial investment, broken down as follows:

First £250,000 @3% = £7,500

Second £250,000 @2% = £5,000

Remaining £500,000 @1% = £5,000

Total initial fee: £17,500

Adviser receives 2/3: £11,667

It's worth noting that tiering applies to each contribution, and existing investments are not taken into account. Client two, who is contributing £30,000 a year (£20,000 to the pension, £10,000 to the ISA), will pay 3% on the contribution (£900 assuming no discounting) rather than the discounted 1.75% that the initial contribution received.

One potential challenge we see for potential clients in the new world is the possible increase in initial fees for those with larger pensions. Previously, the pension incurred a 0% explicit fee, so the only initial fee in this example was £12,500 for the £250,000 ISA, versus £17,500 in the new world. This assumes the full 5% initial fee was charged on the ISA. According to a Citywire article, 97% of transactions were undertaken at a 3% initial advice fee, bringing the previous initial fee down to £7,500, and we would expect discounting with the new pricing structure as well for clients with this amount to invest.

Product fees:

The product tiering has less of an impact on overall fee reduction than the initial fee tiering did. For example, in year five, client two is saving around 0.05% a year versus client one (1.55% on a balance of circa £1,360,000 vs 1.6% on a balance of around £280,000).

We will next examine the client with £2m invested, to further investigate tiering and the breakdown between adviser and SJP fees.

Example client three: £2m invested

Our final client has £1,500,000 in pensions and £500,000 in ISAs. They are contributing £50,000 per annum to their pensions and £40,000 to their ISAs.

As with client two, the effects of tiering can be seen, with annual savings of 0.24% per annum (1.67% vs 1.91%) versus the old model.

As with client two, initial fees are increased from £25,000 (5% on the £500,000 ISA) for the old model to £27,500 in the new model (£6,875 on the ISA and £20,625 on the pension), although in both pricing models, we would expect very few to pay headline rates for someone with £2,000,000 to invest.

While there is a reasonable overall cost saving of almost £70,000 over the 10 years analysed (£526,162 vs £595,381), there is no escaping the fact that around 60% (£318,667 out of a total of £526,162) of the overall fee doesn't go to the adviser, who, in our opinion, is providing the vast majority of the value in the relationship. As we mentioned in our previous research, for a client with this amount invested, we would suggest that the non-adviser, commoditised part of the overall package (investment funds and platform) can be offered for less than £10,000 a year, saving over £20,000 per annum for this client.

Conclusion

For the typical SJP potential client, these changes are positive:

Overall fees in general have reduced, making them even more competitive for the typical client with £190,000 invested, versus other wealth managers.

Product (ISA, pension, etc) pricing has been aligned.

Exit charges have been eliminated, meaning it is easier for clients to find another offering if their adviser isn't delivering what they are looking for on an ongoing basis.

The adviser is paid slightly more on an ongoing basis, enabling them to offer a better service.

As described above, we feel there is still some room for improvement, including:

Greater reduction in fees for clients with bigger pots, meaning less pressure for advisers to discount.

No initial fees for annual top-ups. These could be included as part of the ongoing yearly fees.

The adviser could be paid a larger portion of the ongoing fee.

Exit fees could be removed for existing clients. Some may currently feel trapped until the 6-year window is up, unwilling to pay an exit fee, which in some cases can run well into five figures.

However, no fee model is perfect, and most feel that the new structure is a big step in the right direction!

About Pyrford Financial Planning

Pyrford Financial Planning is an Independent Financial Adviser based in Weybridge, Surrey.

We specialise in retirement planning and provide independent financial advice, including pension and investment advice, and inheritance tax planning.

We offer a no-obligation introductory meeting, which will be held over Zoom.

Our office telephone number is 01932 645150.

Our address is No. 5 The Heights, Weybridge, Surrey, KT13 0NY.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Although best efforts are made to ensure all information is accurate, you should not rely on this blog for your personal situation or planning.

The value of your investment can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

About the author

Noel is passionate about helping clients plan for retirement, preparing and guiding them through this key life transition. He has written a book on retirement planning and regularly publishes retirement research on this blog.

Comments