Our Process

We have a clearly-defined, thorough and tested retirement planning process.

Step One: Introductory meeting

The purpose of this meeting is:

-

To ensure your situation matches our retirement planning expertise.

-

To see if we are a good fit.

-

To explain the process we take our clients through at Pyrford Financial Planning.

-

To answer any questions you may have about us or the service we offer.

30 minutes

Step Two: Discovery Meeting

This meeting will be a chance for us to discuss your retirement goals, needs and concerns.

We will build a picture of your situation, and at the end of the meeting, if we are a good fit, we will discuss the next steps and the fees for our services should you decide to proceed.

1 - 2 Hours

Step Three: Initial Retirement Planning

Stage One: Person (Life Planning)

Building a picture of your ideal future lifestyle is the first and most important part of the retirement planning journey. Here you will start to think about how much this will cost and over what timescales.

Stage Two: Plan (Financial Planning)

Together, we will build your financial plan using market-leading financial planning software.

Your financial plan will help answer questions you have, such as:

-

"Do I have enough money to retire now? If not now, when?"

-

"Can I afford to gift to my children and not run out of money?"

-

"How will my quality of life in retirement be impacted if I retire 2 years earlier than I was planning to?"

-

"Am I taking advantage of all available tax allowances?"

The ultimate goal at this stage is to enable us to finalise and integrate realistic goals and objectives and to display them in a format you understand.

Stage Three: Portfolio (Financial Products)

Only once we have a well-established financial plan do we start discussing pensions and investments. We thoroughly analyse your existing holdings using our evidence-based approach to investment management and make recommendations where required.

This exercise involves taking the time to thoroughly understand your risk appetite and how this aligns with the risk required to deliver a successful retirement outcome. We use cutting-edge retirement planning software, including Voyant and Timeline, to help us achieve this.

If investment changes are required, we will deal with the providers on your behalf to implement the new solutions.

By the end of this stage of the process, you will have an investment portfolio that helps deliver the returns required to provide a sustainable retirement income.

The value of investments, and the income from them, can fall as well as rise and you may not get back the full amount invested

Stage Four: Withdrawal strategy

Finally, we will develop a withdrawal strategy to give you the confidence to spend your money in retirement without fear of running out of money.

3-4 meetings

Step Four: Ongoing Retirement Planning

A Nobel prize winner once said that retirement planning was the nastiest, hardest problem in finance, with the three future unknowns listed below:

-

Longevity

-

Inflation

-

Investment returns

making for a complex answer to what, on the face of it, seems like a simple question:

'Will I/we run out of money before I/we die?'

We make prudent assumptions during our initial retirement planning process, but the real-world reality is that financial plans are ever-changing. Our ongoing retirement planning service ensures that your financial plan remains robust, flexible, and able to handle turbulent financial markets and unexpected life events.

The Value We Add

We only engage with potential clients where we feel we can add lasting value that will help them enjoy a successful retirement.

Initial Retirement Planning

50%

Creation of your master financial plan

This is where we build a vision of your retirement. We amend and iterate

the financial plan to ensure we have a robust solution that can cope with market volatility and inevitable changes in life plans.

20%

Establishing realistic and achievable goals and objectives

This involves working with our clients to help them identify and establish their financial goals and objectives. We will revisit these as we build the retirement plan.

20%

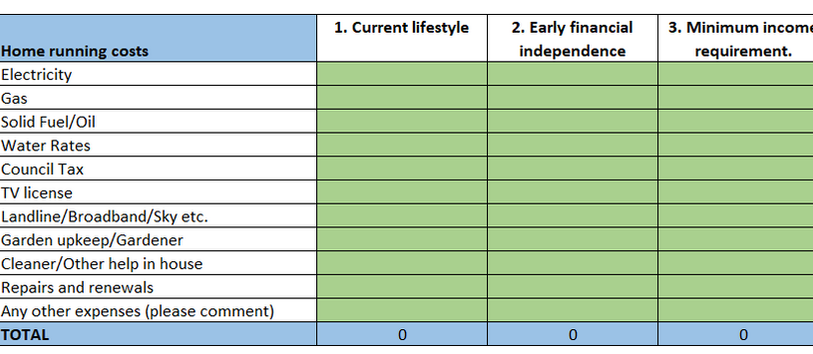

Thorough analysis of expenditure and budget optimisations

We often find that our clients are unaware of how much they are currently spending. We work with them to understand current outflows, how these are likely to change as they transition into retirement and identify where savings may need to be made.

10%

Analysis of current investments and recommendations

We ensure existing and new money is best positioned to help make your retirement plan a success. We will implement changes where required.

Ongoing Retirement Planning

50%

Sticking to the financial plan

We use our skills, experience and knowledge to help you to make better financial decisions. For example, in times of market volatility, we will strive to ensure you do not make impulsive decisions, showing you that temporary (and history has proven to be always temporary) market drops are the price you have to accept for longer-term returns.

We find that having a clear set of objectives and a robust financial plan helps clients stay on track in times of uncertainty.

25%

Providing peace of mind and confidence to spend money in retirement

We ensure that your objectives and goals remain current and encourage you to spend and/or gift your money, knowing you have a robust retirement plan in place.

15%

Objectivity

We offer independent and impartial financial advice and can serve as a sounding board when you make emotionally driven financial decisions.

10%

Ensuring your retirement savings remain optimised

Taxation legislation is continually changing. We will keep you up to date and make sure that your financial plan is as tax-efficient as possible.

Schedule a meeting:

Our tried and tested retirement planning process is designed to give you clarity and peace of mind.

You can schedule a free introductory meeting using the link below: